Drawn by enchanting visions of telecom delights, 1310-nm vertical cavity surface-emitting lasers (VCSELs) have begun the parade to market this year with monthly technology development announcements. For the last couple of years, the optically pumped design by Gore Photonics (Lompoc, CA) has had the 1310-nm limelight all to itself (see Laser Focus World, September 1998, p. 9). But in April of this year, Infineon Technologies (Munich, Germany) announced a gallium arsenide-based 1300-nm VCSEL, operating at OC-192 fiberoptic transmission data rates of 10 Gbit/s with a 1-mW maximum output power and 2-mA threshold current at room temperature, and lasing up to 80°C.

E2O Communications (Calabasas, CA) followed in May with a 1320-nm VCSEL announcement, boasting single-mode continuous-wave powers in excess of 2 mW, spectral linewidths less than 0.2 nm and operation at OC- 192 data rates. Then in June, Cielo Communications (Broomfield, CO) followed a CLEO technical presentation the previous month of its 1310-nm VCSEL with product announcements of a serial transponder and parallel array module based on the device. The Cielo VCSEL is gallium arsenide (GaAs) based, as is the device announced by Infineon, but E2O has yet to reveal the material system in the device it has announced, saying only that it is pursuing both gallium arsenide and indium phosphide technologies simultaneously.

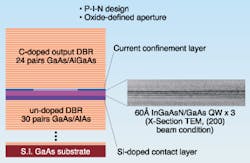

Picolight (Boulder, CO) and Emcore (Somerset, NJ) have not made any product announcements, but Picolight says that it privately demonstrated 2.5-Gbit/s small-form pluggable (SFP) devices based on a GaAs material system at slightly under 1310 nm. Emcore also won't divulge its chosen material system, but says, as does just about everybody else, that it expects to have product samples available by the end of this year or sometime next year. While many of these companies are playing the technological details of their devices close to the vest, Cielo gave a thorough device description at CLEO (see Fig. 1).The gallium arsenide technology at Cielo and at other companies that were willing to discuss it at all is based on an indium gallium arsenide nitride active region that allows gain in the GaAs material system using aluminum gallium arsenide (AlGaAs) mirrors, previously only available at shorter wavelengths to be achieved at 1300 nm. The Cielo team reported 1.2-mW single-mode output power at room temperature, threshold current on the order of 2 to 3 mA, lasing up to 125°C, 50 dB of sidemode suppression and 0.05-nm linewidths at 20-dB down as opposed to full-width half-maximum. The VCSEL is about 30 µm in diameter with an active region size on the order of 5 µm, according to Ryan Naone, VCSEL materials engineer at Cielo and lead author on the CLEO paper.New markets, familiar materials

While reliability testing and varying degrees of developmental tweaking still await all of the various 1310-nm VCSEL contenders, proponents of the GaAs-based systems are confident that they will be able to achieve the same kind of results based on proven production processes that have made 850-nm VCSELs so successful. "Once we've perfected the 1310-nm laser structure and introduced that to the market, the first order that we expect to see would be something like several thousands or tens of thousands of units," said Warner Andrews, vice president of marketing at Picolight. "So you don't want to be betting on a brand new material because this is the first time anybody has ever tried to build 10,000 of them. We want to use a proven material structure and make sure that we test improvements thoroughly before we announce products."

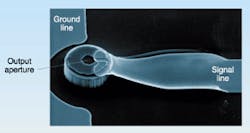

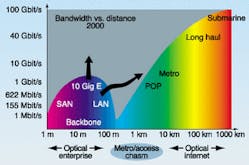

Andrews' bullish market outlook is based on high shipping volumes in current applications—such as OC-48 and OC-192 transceivers and Ethernet and Fiber Channel extenders—that is maintaining strong growth among equipment suppliers in this market despite the current economic downturn. "Picolight has managed to generate two quarters of double-digit growth on the order of 30%," he said. "We think the reason for that is that we're focused on optics at the edge of the network, not optics at the core, and that we're focused on the next-generation platforms." Growth in these areas is driven by current transitions from GBIC [gigabit interface converter] form factors for gigabit connectivity to SFP form factors, and from 1-Gbit to 2-Gbit Fiber Channel. In the midst of all of this, long-wavelength VCSELs are likely to facilitate the extension of enterprise optics into the metro area, he added (see Fig. 2).While Andrews and others generally describe VCSELs as the impending replacement for edge emitters, Brian Gibson, director of business development at Emcore speaks about 1310-nm VCSELs with clearly tempered enthusiasm. "We don't see this as the panacea for long wave or even a replacement for 850s," he said. "It certainly brings some interesting applications into the reach of the VCSEL, but the 850s are very strongly entrenched in Gigabit Ethernet and Fibre Channel, and certainly in the VSR [very short reach] OC-192." Gibson said VCSELs will never enter the VSR realm because of the coupling costs.

Gibson believes the 850s will offer an advantage of coupling efficiency and price for years to come for VSR applications, and edge emitters are fairly entrenched with the low price in metro. Nonetheless, "VCSELs will get some of that business," he said. But he expects to see particularly strong VCSEL growth in arrays. "Parallel optics are starting to take off and that market is going to overwhelm what Gigabit Ethernet and Fibre Channel did for the single channels." There are also numerous other VCSEL applications, he added. Vendors also benefit from a higher average selling price when they sell an array of 12 VCSELs instead of just one. "But in a year or two years we will be selling as many arrays as we are singles," Gibson said.