Trying to pin down market growth rates within the wide-ranging photonics world offers challenges, unlike other more easily definable industries. With no government statistical bureaus defining and tracking the sectors and subsectors, the photonics community looks to multiple sources, each of which takes a slightly different approach.

But that’s OK. Together, the photonics market trackers’ projections paint a comprehensive—and bright—future, highlighting fast-growth areas and identifying issues that will challenge photonics companies.

At its Global Business Forum at Photonics West late last month, SPIE brought together several analysts to help executives gauge market conditions, understand what’s driving them, and strategize around them.

First, SPIE Senior Director of Global Business Development Andy Brown revealed highlights from the organization’s 2024 forecast.

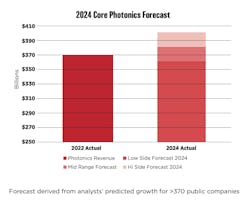

The organization has tracked photonics core components revenue using the same methodology since 2012. First, they identify companies that produce these components globally (nearly 5000), then determine and attribute revenues in the currency based on the country where the company is headquartered, and finally convert revenues into dollars allowing global trend comparisons. A forward-looking forecast using a subset of the companies (370) for which analysts have published projections provides insight into expected trends in 2024 and beyond.

The consistent methodology lends itself to more accurate year-to-year comparisons, noted Brown.

For 2024, SPIE’s forecast ranges between $360 billion, a 2.5% contraction from 2022 actuals, to $401 billion, an 8.9% expansion. “It’s optimistic and pessimistic in the same chart,” Brown said, explaining that they decided to “take the middle of the road of about $379 billion, which would be about a 3% growth over 2022.”

He noted that SPIE based its projection on data collected in the fall of 2023, adding, "and we’ve had a lot of changes in the world since then. Unfortunate changes, some of them.”

For perspective, Brown said that photonics grew at a 12-year CAGR of 7%, including this year's projection.

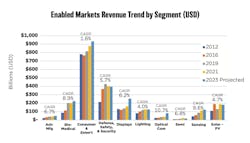

Moving upstream, Brown also shared SPIE’s analysis of market segments enabled by photonics components, including consumer, defense, biomedical, etc., to which he attributes the component segment’s steady growth. “Photonics underpins a diversity of applications,” he said. “And that brings resiliency because most companies are feeding into more than one market."

The view from Europe

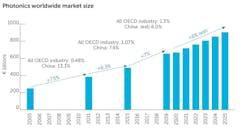

Thierry Robin, a partner and cofounder of TEMATYS, near Paris, presented another view of the market based on a definition of photonics components different from SPIE's. The company details its definition in a report published by Photonics21 that features its analysis. (In March, Photonics21 will publish an updated report.) Robin and Brown noted that both analyses forecast the same growth over the last ten years despite the differences—7% for TEMATYS and 7.3% for SPIE.

Drilling into a detailed analysis of specific components, Robin said that TEMATYS forecasts all the segments will grow between 7% and 10% from 2022 to 2027. He highlighted the projected growth rates of the following segments:

- Photon sources: LEDs will grow by 8% and lasers by 7%, driven by new, affordable wavelengths and a better power ratio.

- Optical components: discrete optics will grow by 7% and optical fibers by 10%, driven by a shift toward compact assemblies and rapid/precise beam steering.

- Photonic sensors: single and imaging detectors will grow by 8%, driven by new, affordable wavelengths and on-chip functions.

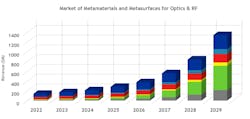

Robin also estimated the market for photonic integrated circuits (PICs), which incorporate lasers, optics, and sensors, at “around $1 billion for the chips” and highlighted two fast-growing emerging technologies: metamaterials for optics and RF and chip-size spectrometers. “The market for optical metasurfaces is expected to grow rapidly, especially because they are already used in smartphones and microelectronics and will be used in artificial reality (AR), virtual reality (VR), and display applications,” he said.

TEMATYS forecasts metamaterials and metasurfaces used in optics to grow from $26.6 million in revenue in 2022 to $779 million in 2029. In RF, it projects metamaterial and metasurface use will increase from $112.8 million in 2022 to $560.1 million in 2029.

Metamaterials, aka metasurfaces, use structural patterning of standard materials to enable unique optical properties. Robin noted that in optics/photonics, metamaterial applications include optical filters and combiners that are wavelength or polarization-selective, wavefront-selective metalenses, and active beamforming/beam-steering components. In RF applications, applications include antennas, passive transmitters/reflectors, and active beamforming/beam-switching components.

Within the spectrometer segment, Robin declared, “We are seeing a huge growth of chip-size spectrometers, especially because they are already used in smartphones [for camera enhancement].” Though he did not share specific numbers, a chart in his presentation indicated the market for chip-size spectrometers to over $500 million in 2026, mostly in consumer applications, from an amount barely registering on the chart in 2020.

What’s driving growth?

Though many Global Business Summit presenters shared photonics market growth drivers, Robin offered a strong summary:

- An escalating need for high-speed data transmission to meet the demands of digitalization, machine learning, and the Internet of Things (IoT), which continues to evolve.

- The expansion of remote vision and sensing technologies for AR/VR, autonomous vehicles, advanced driver-assistance systems (ADAS), process automation, and unmanned reconnaissance.

- Advancements in digital and additive manufacturing to enable increased precision, reduced waste, and greater design flexibility.

- A rapid evolution in health care and life science to enable better diagnostics, personalized medicine, and innovative treatments.

- An increased focus by governments on innovation for defense and surveillance and to strengthen their supply chains, as governments work to deal with geopolitical instability.

What about China?

Bo Gu, founder, president and CEO of BOS Photonics (USA and China) and Laser Focus World contributor, shared an update on China’s industrial laser and related markets. Much of his presentation was featured in an LFW feature, “China’s industrial laser market shows steady growth in turbulent times,” in late December.

Still, Gu summed up the optimism on display at the Forum, which also reviewed challenges the photonics community will face in the coming year (more on that in a future article), declaring, “The next decade is the Golden Decade for our industry.”