MERRILL APTER

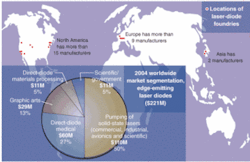

The worldwide laser-diode market can best be described as an oligopoly; an industry of many, controlled by a few. It consists of more than 25 companies worldwide that are competing for a pie, which Strategies Unlimited (Mountain View, CA) said in January 2005 is only about $225 million in size. These 25 companies are located throughout North America, Europe, and Asia (see figure). The controlling few are located in North America and Europe. They include (in alphabetical order) Coherent (Santa Clara, CA), Dilas Diodenlaser (Mainz, Germany), JDS Uniphase (JDSU; San Jose, CA), JenOptik Laser Diode (JOLD; Jena, Germany), and the Spectra-Physics Division of Newport (Mountain View, CA).

There seem to be several philosophical differences between manufacturers in North America and their counterparts located in Europe. These differences are in relation to supply chain, product development and technology, and global markets.

Supply chain

European suppliers—primarily Dilas, JOLD, and Thales Laser Diodes (Orsay, France)—tend to focus their supply chain on what might best be described as the back end of the process, or “packaging.” European suppliers, historically, tend to view vertical integration as a noncritical factor in their supply chain. In this case, they outsource the epitaxial growth process, and view the unmounted bars (with mirror-facet coatings on them) as a “commodity” that they purchase, package, and then resell.

North American suppliers are, for the most part, “vertically integrated” and appreciate the advantages of controlling the entire supply chain, from epitaxial growth through processing and mirror-facet coating to packaging. Manufacturers in North America see epitaxial growth as a critical part of the supply chain because it allows better engineering and optimization of laser-diode structures, thus improving diode output in terms of quantum loss, efficiency, and performance. It also allows manufacturing customizability, with a host of volume opportunities demanding a variety of wavelengths, from 797 to 808 nm, 825, 880, 1470 nm, and beyond. In contrast, European suppliers tend to focus on just two wavelengths: 808 nm (used as a pump source for Nd:YAG, Nd:YVO4 lasers) and 940 nm (used as a pump source for Yb:YAG “thin disc” lasers).

Product development

In general, North American suppliers concentrate laser-diode product development on lower-power (less than 500‑W class, 1.06-µm) industrial, commercial, and scientific diode-pumped solid-state (DPSS) lasers, and product development in Europe is dedicated to and driven by the needs of the automotive industry, which purchases multikilowatt (1- to 4-kW) DPSS lasers for automobile welding.

In North America, “ultrahigh” power and brightness is king. Manufacturers are focused on higher and higher continuous-wave (CW) output power from a 1-cm laser-diode bar rated from 80-, 100-, or even 150-W continuous wave. This was clearly seen at the Photonics West conference in January. The mean-time-between-failure (MTBF) rating demanded by end users of these industrial, commercial, and scientific DPSS lasers is on the order of 25,000 to 35,000 hours.

Europe has a different focus. In Europe, “ultralong reliability” is considered king of the industry, and thus directs European manufacturers’ product development. European suppliers tend to work with, and focus development efforts on, increased lifetime, using 50- and 60-W CW 1-cm bars. Here, the demands of the automotive industry lead suppliers to develop MTBFs of at least 50,000 hours.

Driving forces in global market segments

In the 1990s, the European market matured into its current incarnation, due primarily to financial support from the German government. Dilas, JOLD, and Siemens began producing large quantities of pump laser diodes at 808 and 940 nm to supply the needs of the automotive industry, and in the U.S. the market was driven by lower-power DPSS lasers and the needs of the military, yet with only modest to no government input. In the U.S., the laser-diode market was first driven by the commercialization of the DPSS laser (795 and 808 nm) in the 1980s, then by the graphic-arts industry (825 nm) in the mid-1990s, and then by dermatology applications (laser-diode hair removal using 810‑nm bars) in the late 1990s.

The philosophy in the U.S. was focused more on innovation and enabling new markets, with laser-diode companies competing to improve epitaxial structures, to develop and produce new wavelengths and packages, and to reliably manufacture higher-power laser diodes for an existing wavelength. The idea was that new technology would drive new applications and create new markets while exploiting existing ones. If the new laser-diode options were available, industry would find uses for them. And they did. Diodes were produced as pumps for DPSS lasers, which are, today, for all intents and purposes ubiquitous in the via-hole-drilling market, as well as in the DPSS marking and engraving industry. Other wavelengths were used by OEM applications for scientific, industrial materials processing, and therapeutic and diagnostic medical equipment.

Coming together

Interestingly, we anticipate that current trends in the market will actually flip. Europe will begin to focus on higher-power 1-cm bars, while still desiring a few select wavelengths and remaining dedicated to a few key industrial applications. In North America, the attention and focus will shift to laser-diode heatsink and packaging—striving for MTBFs greater than 80,000 hours across a wide range of wavelength offerings. Perhaps North America will still be seen as a leader in innovation, producing diodes in all colors of the spectrum, while continuing to increase the power output of these products.

Regardless of where Europe and North America choose to focus development, in the next five to ten years we can anticipate that the laser-diode market will continue to expand and will be dominated by new commercial applications—the consumer aesthetics market, the commercial laser-display market, and the automotive tail-light illumination market, among others. As technology advances in the laser-diode field, diodes will become ubiquitous. And, just as the nascent laser industry in the 1960s could not have predicted all of the varied market applications available today, we too can expect to be surprised by innumerable new laser-diode applications in the years to come.

Merrill Apter is vice president of sales and marketing at nLight Photonics, 5408 NE 88th St., Building E, Vancouver, WA 98665; e-mail: [email protected].